Wegmans

Share price: RM0.36 (15/8/2018) Total shares issued: 500m

Market Cap: RM180m (15/8/2018) Annualized P/E: 12.12

Top 30 shareholders: 88.68% Listing

Date: 6/3/2018

After writing the article last night, Ringgit had once again

break another psychological resistant level of RM4.10.

Coincidentally, 1 of our top 3 counters Wegmans had announced

their quarter result today. The result is quite surprising as they manage to

turn around from Red to Green this quarter.

Their PAT is RM3.7m @ RM0.0074, if we annualize the earning

of the company, we can see that their EPS will be around RM0.0296 which is

trading at 12x PE.

Let’s take a look at the Qr commentary of the company.

1st we can see that the Average selling price of

Wegman’s is higher for this quarter.

2nd The strengthening USD will yield foreign

exchange gain to the company.

3rd The company is increasing their production

capacity.

For the 1st point, we can’t really comment much

as this info is not something that outsider like you or I could simply acquire.

However, 2nd point is an info that we can acquire from the public

available data.

Looking at the 2nd point, we could see that the

USD movement will affect the earning of the company. Why?

According to the prospectus, approximately

98.42% and 9.53% of the revenue and purchase are denominated in USD. While the 1.58% and 90.47% of revenue and

purchase are denominated in RM. This makes Wegmans to be a total beneficiary of strong USD.

1. USD

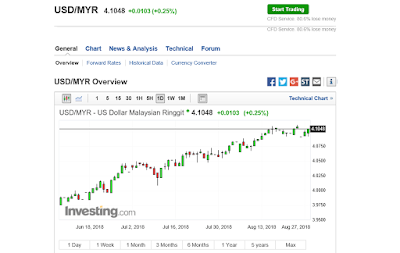

Now, let’s do a comparison of USD movement towards the

result Wegmans.

As we can see, USD was traded below RM4 for 1st

half in 2018, however, we started to see that USD begin to trade above RM4

again in June.

RM is now traded at RM4.10 for this month.

USD averagely traded at

1st Q: (3.901+3.917+3.8635)/3 = RM3.8938

2nd Q: (3.9215+3.98+4.0395)/3 = RM3.9803

3rd Q: (4.0613+4.10)/2 = RM4.0807

*we are just at 2nd month for 3rd Q

and we assume that RM close at RM4.10 for August

As we can see on the comparison above, Wegmans is doing

quite well on this quarter compare to last quarter, this is due to USD is

averagely traded at RM3.9803 compare to RM3.8938.

As of today, USD is traded at RM4.1040. Assuming USD will be

trading at this level for August and September, then we will see the average of

USD against RM will be around RM4.08.

If this assumption materialise, and every other thing remain the same then we will be surely seeing growth in Wegmans earning.

Source: Prospectus

As we can see from the prospectus, the company is strongly affected

by USD movement.

2. Growth theme

The reason for Wegmans to get IPO is to get

money for expansion, this expansion will help to increase Wegmans capacity by

100%.

According to prospectus:

As u can see, Wegmans will be increasing their

productions line by 100% and will commence production in 2019. This will be the

biggest catalyst to the company. This is because I found that not much players

from this industry is expanding their business currently.

As a result, they will be the

sole industry player that is expanding their production capacity which make them the only GROWTH stock in this industry.

3. PE

If we were to look at the PE of the Wegmans that

is trading at 12 times, we might be thinking that Wegmans are trading at the

high side compare to their peers.

According to the annualized EPS of 3c per

share, the PE of Wegmans which traded at current price of RM0.36 is about 12

time, which is highest amongst market player.

Anyway, we can see that:

1.

Liihen:

87% revenue from USD, 80% of product exported to US & Canada, 2800 workers.

Factory got burnt down and rebuilt, expected to resume production in June 2018.

(95% revenue from USD in 2016).

2.

Homeritz:

99% revenue from USD and 70% purchase from USD.

3.

Pohuat:

69% & 22% of revenue are from Canada, 1000 workers in Malaysia & 4700

in Vietnam. (Binh Duong expansion in 2016 due to fire and increased 20%

production)

4.

Latitude:

Expansion in 2016 and 2017 which already completed. 97% of revenue and 84% of

cost are denominated in foreign currency. 7000 workers.

5.

Jaycorp:

27.6% of the revenue derive from North America.

6.

Wegmans:

approximately 98.42% and 9.53% of the revenue and purchase are denominated in

USD. While the 1.58% and 90.47% of revenue and purchase are denominated in RM.

They are also expanding where their capacity can grow by 100% after their new

production completed

Among all the industry player, Pohuat and Latitude is the

only company that have expansion in the past year. As a result, we can see that

Wegmans is the only company that has new production line coming up will be

increasing their production capacity by 100% and making them the only growth

stock in this industry.

Even Wegmans is trading at 12 times PE right now, however,

it is worth noting that Wegmans is building their new production line which

will increase their capacity by 100% and is slated to complete by 3rd

Q of 2019.

Under Blue sky scenario: Assuming the new capacity will hit 90%

utilisation rate, this will help to increase the company’s profit by 90%

(optimistically). This also mean that the current profit of RM14.5m increase by

RM13m to RM27.5m. With current market cap of RM180m which mean Wegmans is now

trading at Forward PE of only 6.5 times which is lowest compare to the industry

players that being compared above.

However, I believe that it would be better for us to be not

that optimistic, hence, it would be better if we take utilisation rate of 50%

for the new production line.

As a result, I would assume the new production

line will also increase the net profit by 50% which is RM7.5m. Hence the total

profit will be RM22m. With current market cap of RM180m, then the Forward PE

will be 8 times.

Assuming the company should be traded around their peers,

which is around 10 times, hence, with the profit of:

a.

RM27.5m @ EPS RM0.051 = the company should be

traded at RM275m with a total shares of 500m then it will be at RM0.55 per

share.

b.

RM22m @ EPS RM0.044 = the company should be

traded at RM220m which is RM0.44.

However, this company still has a lot of corporate exercise

can be done, hence, it would be justifiable to trade at slightly higher PE

compare to the industry players.

4. Corporate Exercise

a.

Change to mainboard

If we were to look close at Wegmans’ account, we can see that they’ve

been making more than RM6m a year and they have more than RM20m profit for the

past 5 years. As a result, they are already qualified to change Mainboard and I

believe this is a matter of time.

b.

Issuing warrants

A way of rewarding their shareholders which can be done concurrently with

mainboard transferring.

By

having these corporate exercise on the card, hence it would be justifiable for

the counter to trade at premium compare to its peers.

Summary

In short, Big Canon Finance understand that Wegmans will be

the black horse that benefited from Strong USD. Big canon expect the quarter

result of Wegmans will be getting better as long as USD able to trade around

RM4.10.

On the other hand, they are also expanding their production

capacity by 100%. Under blue sky scenario, the company profit could go up together

by 100% with their increase of production line too!

Wegmans are potential to have corporate exercise such as

transferring to mainboard and also bonus warrant.

After looking at the potentials of the company, I think this

company will be doing well as long as the USD are trading at the high side. I

believe this company deserve a higher PE compare to its peers due to the

catalyst they have.

With all the catalyst that embedded in Wegmans, could the

investment bank start to initiate research report about it? Ermmmmmmmmmm…. Hopefully...

Please always bear in mind that Big canon is not giving any buy or sell call, always bear in mind, Big Canon don’t give buy or sell call. Our articles only serve for education & sharing purposes.

May all the HUAT be with us!

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice.

All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument.